Unknown Facts About Empower Rental Group

Unknown Facts About Empower Rental Group

Blog Article

The 15-Second Trick For Empower Rental Group

Table of ContentsMore About Empower Rental GroupThe Ultimate Guide To Empower Rental GroupThe Ultimate Guide To Empower Rental GroupThe Best Strategy To Use For Empower Rental GroupEmpower Rental Group - An Overview3 Simple Techniques For Empower Rental Group

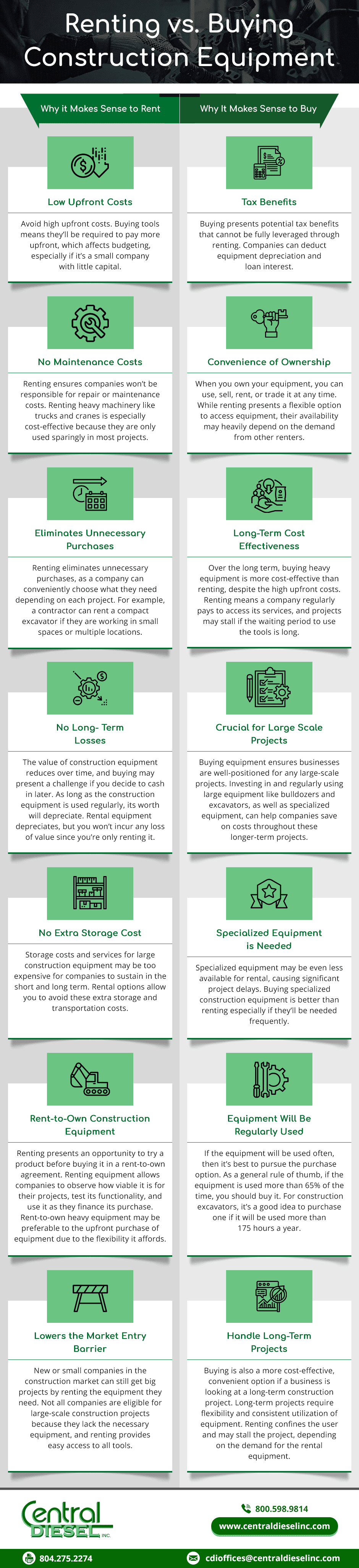

Take into consideration the main variables that will certainly aid you decide to buy or lease your building and construction equipment. Your present financial state The resources and abilities available within your business for supply control and fleet management The prices connected with acquiring and how they compare to leasing Your demand to have devices that's readily available at a moment's notification If the owned or rented out tools will be utilized for the proper length of time The biggest determining factor behind renting or purchasing is exactly how typically and in what fashion the hefty devices is utilized.

With the various uses for the multitude of building devices products there will likely be a couple of equipments where it's not as clear whether leasing is the most effective option financially or buying will offer you much better returns in the lengthy run (dozer rental). By doing a couple of basic estimations, you can have a respectable concept of whether it's finest to lease building tools or if you'll obtain the most gain from buying your tools

Not known Factual Statements About Empower Rental Group

There are a variety of various other elements to consider that will certainly enter into play, but if your organization makes use of a specific piece of devices most days and for the lasting, then it's likely easy to establish that a purchase is your best method to go. While the nature of future tasks may transform you can compute an ideal hunch on your usage rate from recent use and predicted projects.

We'll discuss a telehandler for this instance: Check out using the telehandler for the past 3 months and obtain the variety of complete days the telehandler has been utilized (if it just ended up getting used part of a day, after that include the components approximately make the matching of a complete day) for our example we'll state it was utilized 45 days. - equipment rental company

The Best Strategy To Use For Empower Rental Group

The use price is 68% (45 divided by 66 equals 0.6818 multiplied by 100 to obtain a percent of 68) - https://www.behance.net/richardwhirley3. There's absolutely nothing wrong with projecting usage in the future to have a best hunch at your future use price, specifically if you have some quote potential customers that you have a great chance of getting or have forecasted tasks

If your usage price is 60% or over, buying is typically the most effective selection. If your usage price is in between 40% and 60%, after that you'll desire to think about just how the other variables connect to your company and consider all the advantages and disadvantages of having and leasing. If your utilization rate is listed below 40%, renting out is generally the most effective choice.

Some Known Questions About Empower Rental Group.

You can depend on a resale worth for your devices, especially if your business likes to cycle in brand-new devices with upgraded modern technology. When thinking about the resale worth, consider the brand names and versions that hold their worth better than others, such as the trustworthy line of Cat tools, so you can realize the highest possible resale value feasible.

Unknown Facts About Empower Rental Group

It may be an excellent way to increase your company, yet you likewise need the ongoing organization to increase. You'll have the purchased tools for the sole use your company, but there is downtime to handle whether it is for maintenance, repair services or the unpreventable end-of-life for an item of equipment.

Nonetheless, you can't be particular what the marketplace will be like when you're excited to sell. There is warranted issue that you will not get what you would have anticipated when you factored in the resale worth to your purchase choice five or ten years previously. Even if you have a tiny fleet of tools, it still requires to be correctly managed to obtain one of the most set you back savings and maintain the devices well preserved.

Fascination About Empower Rental Group

You can outsource tools monitoring, which is a feasible option for numerous firms that have found acquiring to be the most effective selection yet do not like the extra job of devices management. As you're considering these benefits and drawbacks of acquiring construction devices, see how they fit with the method you operate currently and exactly how you see your company 5 and even 10 years in the future.

Report this page